The 15-Second Trick For Final Expense In Toccoa Ga

Table of ContentsUnknown Facts About Medicare Medicaid In Toccoa GaRumored Buzz on Final Expense In Toccoa GaInsurance In Toccoa Ga Can Be Fun For AnyoneMedicare Medicaid In Toccoa Ga for Beginners

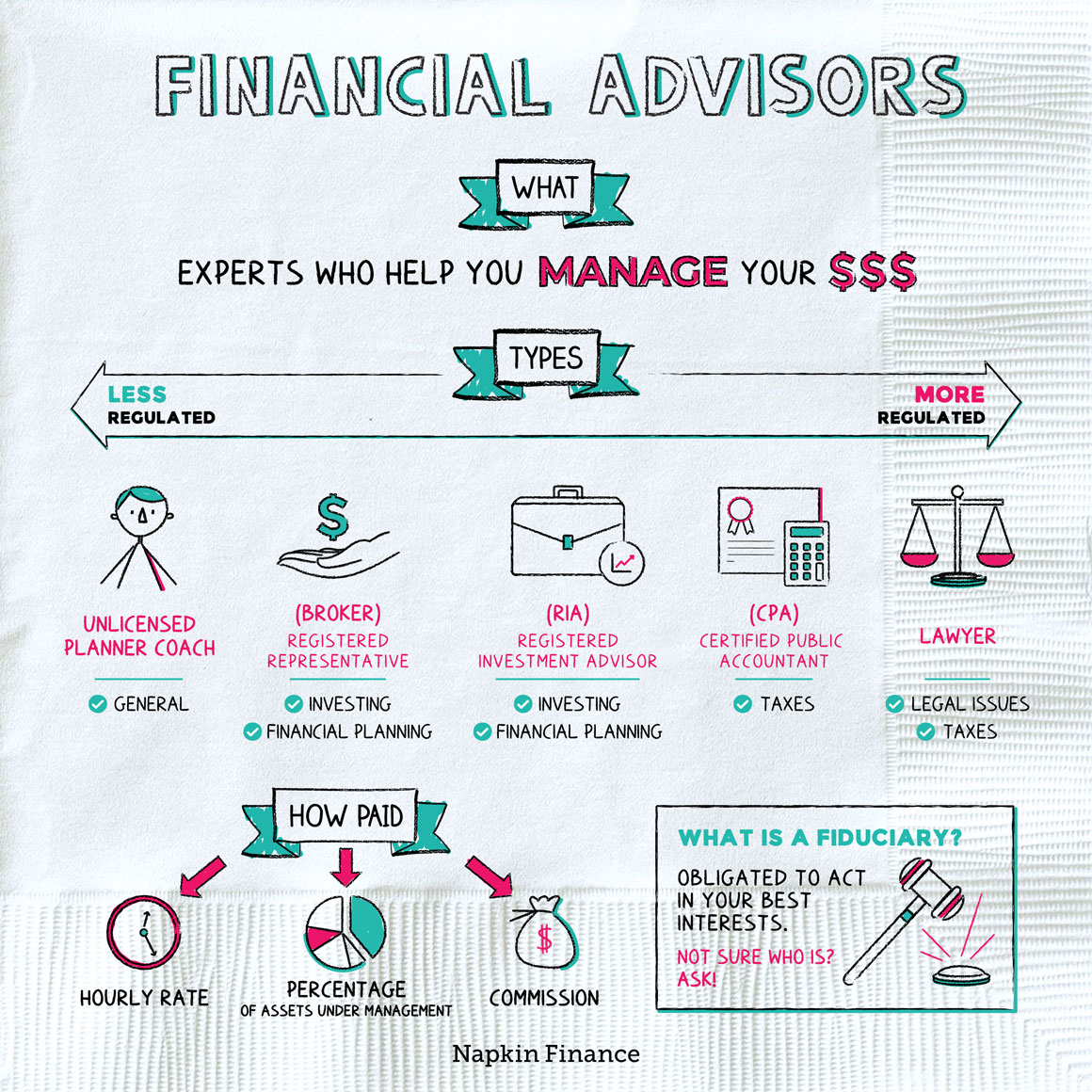

A monetary expert can also assist you make a decision exactly how finest to attain objectives like conserving for your youngster's college education and learning or paying off your financial debt. Monetary consultants are not as well-versed in tax law as an accounting professional might be, they can offer some guidance in the tax planning process.Some monetary experts provide estate preparation services to their customers. It's important for monetary advisors to stay up to date with the market, financial conditions and consultatory best techniques.

To sell investment products, consultants need to pass the appropriate Financial Sector Regulatory Authority-administered tests such as the SIE or Series 6 examinations to get their certification. Advisors who desire to market annuities or other insurance items need to have a state insurance permit in the state in which they intend to market them.

Home Owners Insurance In Toccoa Ga - Truths

You hire a consultant that bills you 0. Because of the regular cost framework, many advisors will not work with clients that have under $1 million in properties to be taken care of.

Financiers with smaller portfolios may look for out a financial consultant who charges a hourly charge rather than a portion of AUM. Per hour costs for advisors commonly run between $200 and $400 an hour. The even more facility your monetary situation is, the even more time your consultant will certainly need to dedicate to managing your possessions, making it more pricey.

Advisors are knowledgeable professionals who can assist you establish a prepare for economic success and apply it. You might also consider connecting to an expert if your personal financial circumstances have recently become much more challenging. This can indicate acquiring a house, marrying, having youngsters or getting a large inheritance.

Insurance In Toccoa Ga for Dummies

Before you satisfy with the consultant for a preliminary appointment, consider what solutions are most crucial to you. You'll want to look for out a consultant who has experience with the services you desire.

The length of time have you been recommending? What business were you in prior to you entered into economic advising? Who makes up your common client base? Can you provide me with names of a few of your clients so I can discuss your solutions with them? Will I be collaborating with you straight or with an associate expert? You might additionally want to look at some sample monetary strategies from the consultant.

If all the samples you're given coincide or comparable, it may be a sign that this advisor does not properly customize their advice for each and every client. There are 3 main types of financial recommending specialists: Certified Monetary Organizer professionals, Chartered Financial Analysts and Personal Financial Specialists - https://peatix.com/user/19389913/view. The Licensed Financial Organizer specialist (CFP professional) certification shows that an advisor has fulfilled an expert and ethical criterion set by the CFP Board

Not known Details About Health Insurance In Toccoa Ga

When choosing a financial consultant, think about a person with an expert credential like a CFP or CFA - https://www.40billion.com/profile/1050144873. You might also consider a consultant that has experience in the solutions that are most important to you

These experts are normally filled with problems of passion they're extra salesmen than experts. That's why it's essential that you have an advisor that functions only in your benefit. If you're searching for an advisor that can really provide real worth to you, it is necessary to investigate a number of possible choices, not merely choose the given name that advertises to you.

Presently, several consultants have to act in your "finest interest," however what that requires can be almost void, other than in the most outright click here for more info cases. You'll require to discover a real fiduciary.

0, which was passed at the end of 2022. "They must verify it to you by showing they have taken serious ongoing training in retirement tax obligation and estate planning," he claims. "In my over 40 years of method, I have seen expensive irreparable tax blunders due to ignorance of the tax obligation rules, and it is regrettably still a large issue." "You should not invest with any advisor who doesn't invest in their education.